Investing in and Incentivizing Building Conversions

Abstract

Trends in remote and hybrid work are opening the door to new ways of thinking about the Toronto Region’s approach to building conversions. With the downtown Toronto office vacancy rate peaking at its highest levels since the mid-1990s, and foot traffic significantly reduced compared to pre-pandemic levels, the region is faced with new challenges and opportunities. This article takes a deep dive into the reevaluation of the use of downtown space and how the region can leverage building conversions to address critical industry gaps in growing sectors, such as the region’s thriving life sciences ecosystem – ultimately contributing to the growth of the local and national economy.

Introduction

The global market landscape and how we do business is profoundly changing. The acceleration of the digital economy during and after COVID-19 has put enormous stress on traditional methods of work. As the Toronto Region’s investment promotion agency, Toronto Global is seeing this every day in our discussions with international companies considering expansion into the Toronto Region. It is a reality of the new environment we find ourselves in. In particular, the adoption of the enduring remote and hybrid work trend across the North American economy creates both challenges and opportunities from an economic development perspective. This shifting paradigm has framed the need to reassess the use of space in Toronto’s downtown core, opening up dialogue about making public transit more efficient, improving parks and green spaces, and public-private multi-sectoral collaboration on how to repurpose vacant buildings or underutilized space. To understand the context for this conversation, we first start with the City of Toronto’s post-pandemic outlook and its downtown footprint.

The Future of Downtown

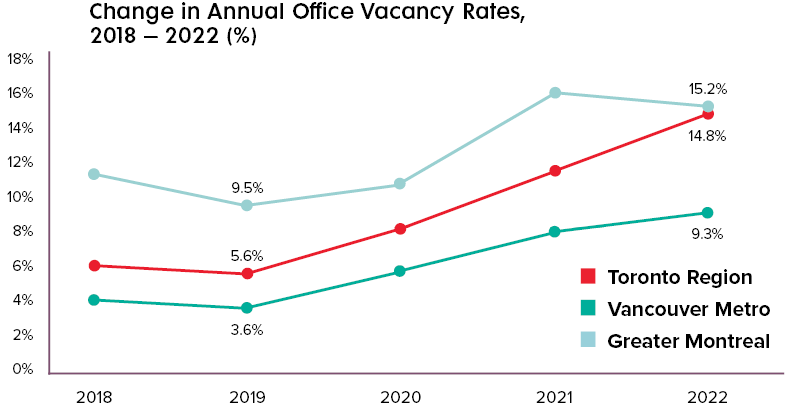

Hybrid work is here to stay, particularly in cities like Toronto. With a significant concentration of employment in the technology, financial and business services sectors, most employers have transitioned to hybrid work arrangements for their employees. The effects cascading from this phenomenon are considerable. A new study by commercial real estate firm CBRE found that the vacancy rate for downtown Toronto office space hit 15.1 percent in the second quarter of 2023, the highest it’s been since 1996. That’s up from just two percent in March 2020, when the pandemic was declared. Consequently, foot traffic has been reduced in the City of Toronto, rebounding to only 65 percent of pre-pandemic levels.

Toronto is not unique in experiencing these problems, but what is unique about the city is the size and scale of office space downtown and the hyper concentration of these jobs – technology, financial and professional services, and R&D – in the core. The interest in establishing offices to access the rich tech, financial and business ecosystem remains desirable. However, businesses are now considering smaller physical footprints and hybrid structures designed for a remote workforce, many opting for coworking spaces or shared workspace environments rather than their own physical address. For many companies, the downsizing of space is accompanied by a change of use – adding collaborative areas designed for in-person meetings rather than ‘heads down’ desk work and looking at regional options outside the downtown core.

Figure 1 shows an overview of the downtown Toronto office supply and demand in Q2 2023, according to the CBRE.i

When considering how to approach these challenges, one can look to other Canadian cities, like Calgary, that were faced with a sharp decline in office space demand in the mid-2010s and discovered ways to repurpose their downtown office stock. With the City of Calgary’s Greater Downtown Plan released in 2021, the goal to transform downtown into an economic and cultural hub involved tower conversions, bike lanes, art centres, community hubs, and more, with a focus on mixed-use buildings. The city’s investment of a quarter billion dollars is dedicated to revitalizing the core by shifting over 6 million square feet of office space to other uses. Calgary turned to converting offices to residential dwellings, discovering that 35 percent of the city’s buildings were top candidates for financially viable conversions. With a cash incentive of CAD $75 per square foot, Calgary was able to set the stage for developers’ success, with new projects expected to increase Calgary’s downtown population by 24 percent.ii

Figure 2.iii

Office vacancy rates in downtown hubs like Toronto (15 percent) and Vancouver (9 percent) are at an all-time high compared to pre-pandemic rates – signaling the changing interest of employers to keep or add office space as remote and hybrid work become foundational strategies. The very nature of remote and hybrid work necessitates taking a broader and regional lens to attracting investment. By analyzing other case studies such as Calgary, the Toronto Region is similarly positioned to leverage building conversions to catalyze the economic revival of the downtown core. A regionally coordinated approach is best suited to understanding, tracking, and designing adaptive responses that governments and economic development organizations should take in order to secure the prosperity and competitiveness of the Toronto Region. These challenges demand a reevaluation of our use of downtown space and how to best utilize vacant space (see Figure 2).

At the Tipping Point

While the rise in office vacancies isn’t new to large cities like Toronto, New York City and San Francisco, policymakers are focused on a variety of broad measures to address these challenges.

Where some see a challenge, Toronto Global sees an opportunity. Toronto Global has identified niche opportunities for regional solutions, particularly in the life sciences sector, which is witnessing an era of unprecedented innovation and growth. Key drivers for the sector include technological leaps in areas such as personalized healthcare, regenerative medicine, genomics and synthetic biology, iv along with the growing convergence of artificial intelligence and big data analytics in healthcare.v Consequently, governments around the world have been supporting historic investments in life sciences; for example, the Canadian Federal government recently committed CAD 2.2 billion in funding toward domestic life sciences and bio-manufacturing through to 2027.vi In April 2023, the Province of Ontario announced the creation of the Life Sciences Council following the release of its life sciences strategy, Taking Life Sciences to the Next Level. The growth in this sector is spurring a boom in the global demand for all types of lab space, specifically wet lab space, and the Toronto Region is no exception.

A wet lab is a specialized laboratory space designed with unique features (equipment, ventilation, storage, etc.) to support cutting-edge life sciences research. The Toronto Region does not have enough capacity to keep up with demand for wet lab space and planned construction is insufficient, constraining the growth of the life sciences industry. Companies looking to “graduate” and scale up their operations in the Toronto Region are being forced to make difficult decisions, including potentially relocating to other cities to find affordable and adequate wet lab space. More wet lab development in the Toronto Region will mean more growing companies – both domestic and international – will come, stay and scale here, further strengthening the region’s life sciences industry. Government has a crucial role to play in financing and providing long term support to grow this critical component of the sector.

Demand Outgrowing Supply

Despite the evolving monetary environment and economic uncertainties impacting venture capital and private equity investment in the sector, demand for wet lab space in the Toronto Region is still far outpacing supply. As Canada’s epicentre in the heart of the Ontario Life Sciences Corridor, there is near-zero capacity for the intensifying demand. With almost half of the life sciences real estate assets owned by users and no vacancy in third-party assets, options for graduation stage companies to grow or scale up remain limited.vii

Figures 3a) and b) show examples of the life sciences companies who have expanded to the Toronto Region, and recent lease transactions occurring over Q4 2022.

The situation in the Toronto Region contrasts with other leading life sciences hubs in North America like Boston, one of the top life sciences clusters in the world, which has ten times the capacity for life sciences companies to grow. The development of wet lab space in cities like Boston, New York and San Francisco includes a significant private sector contingent, driven by real estate companies like Alexandria, BioMed Realty (Blackstone) and Healthpeak Properties, and catalyzed by significant government participation. These companies have collectively invested over USD 3.5 billion in life sciences real estate over the past two years alone.viii

When it comes to wet lab space, Toronto has grown in comparison to other major life sciencesl clusters in North America, most recently ranking as the ninth largest life sciences real estate market overall with 9.5 million square feet of existing building inventory, ahead of cities like Seattle and Los Angeles.ix

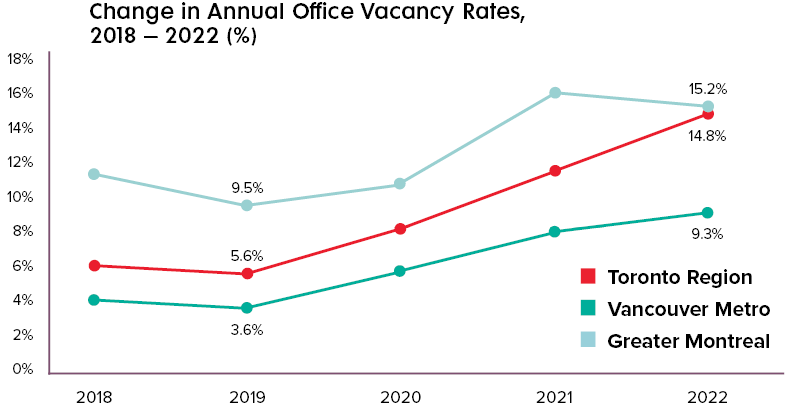

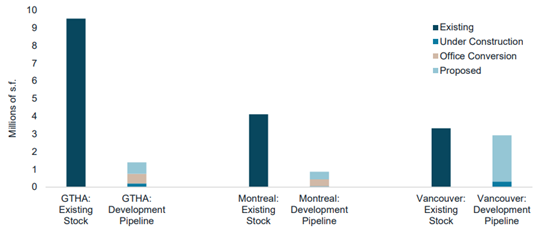

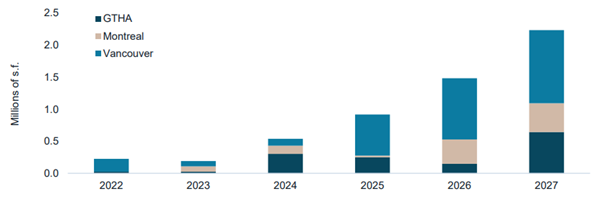

Figure 4 shows the life sciences market comparison across North America, with the Toronto-Golden Horseshoe ranking fourth by overall market inventory. Figure 5 shows the life sciences market inventory in existing and future supply, and Figure 6 shows the life sciences development pipeline in Canada, projected from 2022 to 2027.

Figure 4: Life Sciences Market Comparison, North America

Figure 5: Life Sciences Market Inventory, Existing And Future Supply

Figure 6: Life Sciences Development Pipeline, Canada

The Greater Toronto and Hamilton region has several millions of square feet of unmet lab space demand for specialized infrastructure. Furthermore, the Toronto Region’s rise as a global artificial intelligence hub, a destination for tech talent, and an ecosystem conducive to fostering innovation and research has uniquely positioned the region to spearhead the future of life sciences innovation as AI becomes more integrated with the drug development process. Companies like Recursion, a leading clinical stage TechBio company decoding biology to industrialize drug discovery, have recently set up their Canadian headquarters in Toronto as a reflection of the region as an emerging tech and life sciences global powerhouse.

With several major investment announcements from the biopharma industry and home to 35 percent of the national life sciences labour force, the demand for wet lab space in Toronto is strong. Thus, there is an opportunity to convert lesser-used or vacant office space to wet lab space as part of a larger strategy to re-think Toronto’s downtown, enable industry growth, and attract workers back to the downtown core.

Building Conversion for Wet Labs

While it may make for good policy, converting office space to wet labs is far from easy. Not every office building is suitable for a lab conversion and for buildings that are suitable for conversion, it can be expensive and challenging, from specific floor plate sizing, the heating, ventilation, and air conditioning (HVAC) system, plumbing, specialized filtration, and more. Aspects such as load requirements are top of mind for developers, since lab equipment is significantly heavier than traditional office desks and laptops, which are inherently load-bearing in and of themselves.

Wet labs contain high-end equipment with humidity/temperature control and energy consumption requirements, as well as specific lab design often outfitted with freezers, specialized refrigerators, biosafety cabinets, etc. Moreover, there are any number of municipal, provincial and federal development, zoning, or permitting requirements that may be problematic for the developer. From infrastructure development to equipment requirements to lab space operators and service providers, there is a complex map of pieces required to bring high functioning, multi-tenant lab space on-stream.

Barriers for Development

Multi-tenant developments create stability for commercial developers by spreading risk across numerous companies while providing space and infrastructure flexibility. These developments also decouple the commercial fate of the lab space from that of a specific company since they service an entire pipeline of prospects, each with evolving real estate needs. Multi-tenant spaces are much more likely to succeed if they are managed by a third-party intermediary that helps manage supply, aggregate demand and provide financial reassurance to public and private sector partners. They also provide emerging companies with flexible and expandable space. Multi-tenant spaces are ecosystem assets that can help incentivize start-ups to remain on-site and in the Toronto Region.

However, developers remain wary of the underlying challenges in new lab space development. While cost estimates can vary, office construction costs can fall into the range of CAD 175 – 390 per square foot, while wet lab construction costs are between CAD 500 – 800 per square foot in Toronto. These expensive, specialized facilities may ultimately attract significantly higher rents, but developers and investors considering new projects need to be confident that they can secure long-term tenants. The substantial costs to build out lab space are difficult for developers to justify when prospective tenants carry unconventional financial covenants in an unproven real estate sector. Financial assistance from government would help de-risk the dual challenge caused by high development costs and pre-revenue life sciences tenants. Consequently, more private sector wet lab investment may be within reach. This would be a win for the Toronto Region.

Foreign Direct Investment and Government Incentive

This is where the government incentives and foreign direct investment become a crucial key to the overall solution, by matching the industry demand with real estate, especially when the cost of capital is increasing. The government can consider how Boston, New York and other emerging life science centres in the US and Canada, like Philadelphia, Pittsburgh and Vancouver have helped incentivize wet lab development – by focusing on risk mitigation, financing programs, zoning law incentives, and partnerships between public-private entities – to determine the best approach for catalyzing wet lab development in Ontario. For example, New York launched a USD 500 million initiative called LifeSci NYC in 2016, which included USD 300 million in tax incentives for commercial lab space.

One example being championed by stakeholders is for the government to provide financial assistance in the form of rental subsidies or guarantees. This type of financial underwriting program would provide multiple benefits, including alleviating affordability issues facing these companies, improving finance-ability, and mitigating the default risk for developers.

Programs, such as Toronto’s IMIT program, currently incentivize the construction of new buildings or renovations in targeted sectors, including biomedical operations through grants aimed at offsetting a portion of the property’s municipal taxes. In the Toronto Region, permitting and zoning laws are yet another hurdle that must be addressed. Other jurisdictions provide examples that showcase how zoning and other changes could facilitate the construction of new wet lab buildings here as well.

In recent years, public-private partnership models have proven to be highly successful here in Toronto. For example, the Ontario government and the University of Toronto collaborated with Johnson and Johnson to launch the JLABS incubator in 2016, which is situated in downtown Toronto within the MaRS Discovery District. This was the first JLABS incubator to be located outside the U.S. and is a testament to the Toronto Region’s established strengths in the life sciences arenax. Another example that could serve as inspiration is Biospace 1 in Calgary – a facility that will house companies working on advances in health, wellness and biomedical innovation. This facility is the product of a partnership between DynaLife Medical Laboratories, Biohubx (an NGO that supports life sciences companies) and the Western Economic Diversification Canada fund.xi The British Columbian government also recently announced a $10 million dollar investment in a new wet lab facility with adMare Bioinnovations, to help grow early-stage, local biotech companies by providing access to turnkey-ready wet labs with cutting-edge equipment, as well as meeting and office space.xii

Fortunately, the majority of life sciences roles require wet lab space and equipment to be carried out, attracting talent back to in-office work in the downtown core. This trend leads to benefits like rebuilding of the tax base and high-impact economic projects, such as multi-tenant wet lab spaces or mixed-use buildings. By exploring a variety of incentives and partnership models to attract both high-profile anchor tenants and wet lab developers, these projects can bring about novel partnerships, high-quality jobs, and immense spin-off opportunity.

To learn more about the shortage of wet lab space in the Toronto Region and the importance of the biotechnology industry, check out Toronto Global’s commissioned research on our page, At The Tipping Point.

Conclusion

As a result of the boom of massive unfulfilled demand, the region is at risk of stifling the growth potential of early-stage and mid-stage life sciences companies – both domestically and internationally, for those interested in expanding into Ontario. In turn, the lack of wet lab space has caused companies to look at other North American clusters, slowing our pace of development for novel IP and hampering their ability to recruit top talent.

Solving the wet lab space challenge is a critical driver of high-value economic activity, and the opportunity to convert existing office space into specialized life sciences facilities presents Toronto with a niche opportunity. By mitigating the challenges facing early- and mid-stage companies and de-risking through targeted incentives and programs, the Toronto Region could bolster the investment in wet lab space to retain home-grown companies looking to scale, attracting more foreign-owned companies and simultaneously address office vacancy.

The Toronto Region’s increase in office vacancies, declining foot traffic, and overwhelming demand for real estate in key sectors present an opportunity to reexamine the use of underutilized spaces and the need for a regionally coordinated approach. By incentivizing and investing in building conversions to address critical industry gaps in key sectors, such as life sciences, government bodies and economic development organizations can collectively adapt to the changing environment of the city’s infrastructure, to ensure the prosperity and economic resiliency of the Toronto Region.

Takeaways

- There is a crucial need to reassess the use of space in Toronto’s downtown core, by opening up dialogue about making public transit more efficient, improving parks and green spaces, and using public-private multi-sectoral collaboration on how to repurpose vacant buildings or underutilized space.

- Due to the city’s size and scale of office space downtown and the hyper concentration of jobs in technology, financial and professional services, and R&D, Toronto can look to neighbouring transformations-in-progress like Calgary, to model a regionally coordinated approach toward revitalizing the core by repurposing office space use.

- In a Toronto Global case study, we look at the Toronto Region’s strained capacity for the overwhelming demand for wet lab space, halting the growth potential for the region’s booming life sciences industry.

- Solving the wet lab space challenge is a critical driver of high-value economic activity, and the opportunity to convert existing office space into specialized life sciences facilities presents a niche opportunity to the region.

- Government support and incentives and foreign direct investment become a crucial key to the overall solution, by matching the industry demand with real estate, especially when the cost of capital is increasing.

This article was published in the Fall 2023 edition of the Economic Development Journal, a publication available to members of the International Economic Development Council and is being republished with its permission. To have access to IEDC’s Journal articles and its many services, you can become a member by visiting https://www.iedconline.org.

Daniel Hengeveld is Vice President, Investment Attraction at Toronto Global ([email protected]).